As best practices, investors should check what assets the business owns and what unique selling point it can show.

GERMANY IS AT a turning point — the government’s approval of the Cannabis Act (CanG), a bill to legalize adult-use cannabis within the country, is expected to be in practice in early 2024. Despite this good news, many currently licensed medical cannabis companies were hoping for the legalization of the entire value chain as outlined in the first cornerstone paper. The current two-pillar approach to legalization only allows adult-use cannabis to be supplied to cannabis clubs, limited home grow and regional scientific pilot programs.

In response to this watered-down approach to legalization, the adult-use market will not grow significantly in the short term. Instead, the already existing medical cannabis market will likely consolidate after significant growth in the total number of existing distributors from 2017-2021. However, this comes as no surprise, and forward-thinking companies are already preparing to adapt to what the licensed cannabis landscape will look like next year.

Market consolidation can often lead to a more efficient industry that prioritizes the patients’ interests first. For investors, now is a crucial time to identify the key players in the market who will have a hand in growing the medical market after consolidation — and will be positioned as the first move once the whole value chain is legalized in the long term.

Recap of the German Cannabis Market

As the saying goes, “To move forward, it’s important to know where you’re coming from.” In March 2017, medical cannabis was legalized in Germany. Only Canadian cultivators and Bedrocan, a Dutch cannabis producer, were able to supply the German market. Demand for medical cannabis was high — there were over 100,000 medical cannabis patients in Germany. However, because the market relied solely on cannabis cultivated under the EU’s strict Good Manufacturing Practice (GMP) standards, which was difficult and expensive to produce, there wasn’t enough supply to satisfy the market. During this time, the market’s margins were extreme, allowing many licensed importers and distributors to enter the industry.

Since 2020, cannabis prices decreased, and more cultivators entered the space to meet supply demand. Meanwhile, +100 businesses had applied and successfully received a license for imports and distribution of medical cannabis wholesale. Margins already started to decrease while competition increased. Still, many business owners went along with the status quo instead of looking to innovate in an already crowded market.

This brings us to today’s market. Germany’s backtrack to a watered-down version of cannabis legalization may put some businesses at risk. The businesses that are not using innovative solutions to move the market forward are the most vulnerable.

Key players within the market are those that have not only established a foothold in the import and distribution of medical cannabis but are also leading the charge to make the industry more efficient and geared toward the needs of patients. Today, that need is defined by enhancing the quality of services, utilizing digital assets, developing products according to real-world evidence, and simplifying the cannabis therapy process.

On the opposite end of the spectrum, businesses that are not embracing the next phase of technological advancement and had placed bets solely on the prospects of the entire value chain being legalized as their “rettende Strohhalm” (saving straw), are now likely to find themselves in hot water.

Identifying the Future Winners of Market Consolidation

You can think of the industry as a cake sliced into 20 pieces, representing the more or less 130 licensed distributors just one or two years ago, as estimated by industry experts. Now, that number has already dropped down to around 85 (35% decrease) as of September 2023, according to what industry rumors say. The cake that was once divided into 20 slices is now down to 13 pieces. While the size of the whole cake remains the same (or even will grow), businesses that continue to operate and even grow now control a bigger slice or share of the market.

Consolidation not only offers a concentration of market share but often provides the industry with expansive product lines, greater geographical reach, and a larger customer base. Businesses that survive consolidation are often the ones that have proven business models and are operationally efficient, in good standing with laws and regulations, and fit to meet the needs of a more expansive, diverse clientele.

As best practices, investors should check what assets the business owns and what unique selling point it can show. Factors that make a business lucrative investments are:

• Established distribution channels to pharmacies — not only on paper but supported through real monthly sales.

• Unique digital assets that are able to scale and facilitate the patient experience.

• Uses technology and innovation to drive the ecosystem of the business — whether that’s through telemedicine, pharmacy distribution or end-to-end patient services, among others. The more positions the business can cover on the value chain, the more it can stay autonomous to the changes in the market. It’s important to diversify services to be able to weather these developments.

• Provides accessibility to patients through digitization and automation. The experience should be as easy as shopping online.

• Facilitates research backed by scientific evidence to secure real-world data about the use and effectiveness of cannabis therapy.

• Expertise in different cannabis products and the effectiveness of cannabinoids.

• Ability to drive innovation in product development thanks to real-world data.

• Knowledgeable of the German market and its rules and regulations. Businesses should be in good standing with the law.

Wrapping Up

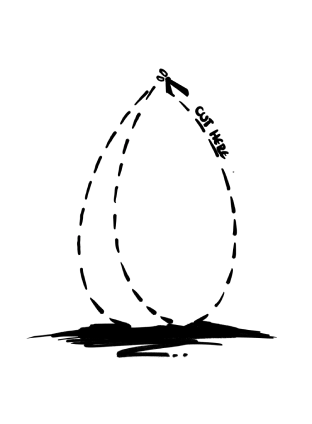

Businesses poised to come out on top are those that do not put all their eggs in one basket. They have diversified their portfolio of services to meet unique aspects of the value chain.

This may include holding companies that perform research on the effectiveness of cannabis on patients and in real-life therapy. Or they may hold digital assets that build out the ecosystem of the industry — from telemedicine to strain and genome development to pharmacy support to home-grow and adult-use products and beyond. Investors should seek businesses that are set to become or establish themselves as integral parts of the end-to-end customer and patient journeys.

Source: Niklas Kouparanis – rollingstone.com

Image: DIY13 – STOCK.ADOBE.COM